Making the Right Investment Choices

- Insight אינסייט פתרונות פיננסיים

- Jul 20, 2023

- 3 min read

Updated: Jan 16, 2024

Making the Right Investment Choices

When I discuss investments with my clients, the first and most important question I ask is 'what degree of risk and profit/loss are you willing to take?'. This is an important factor in understanding their needs and desires.

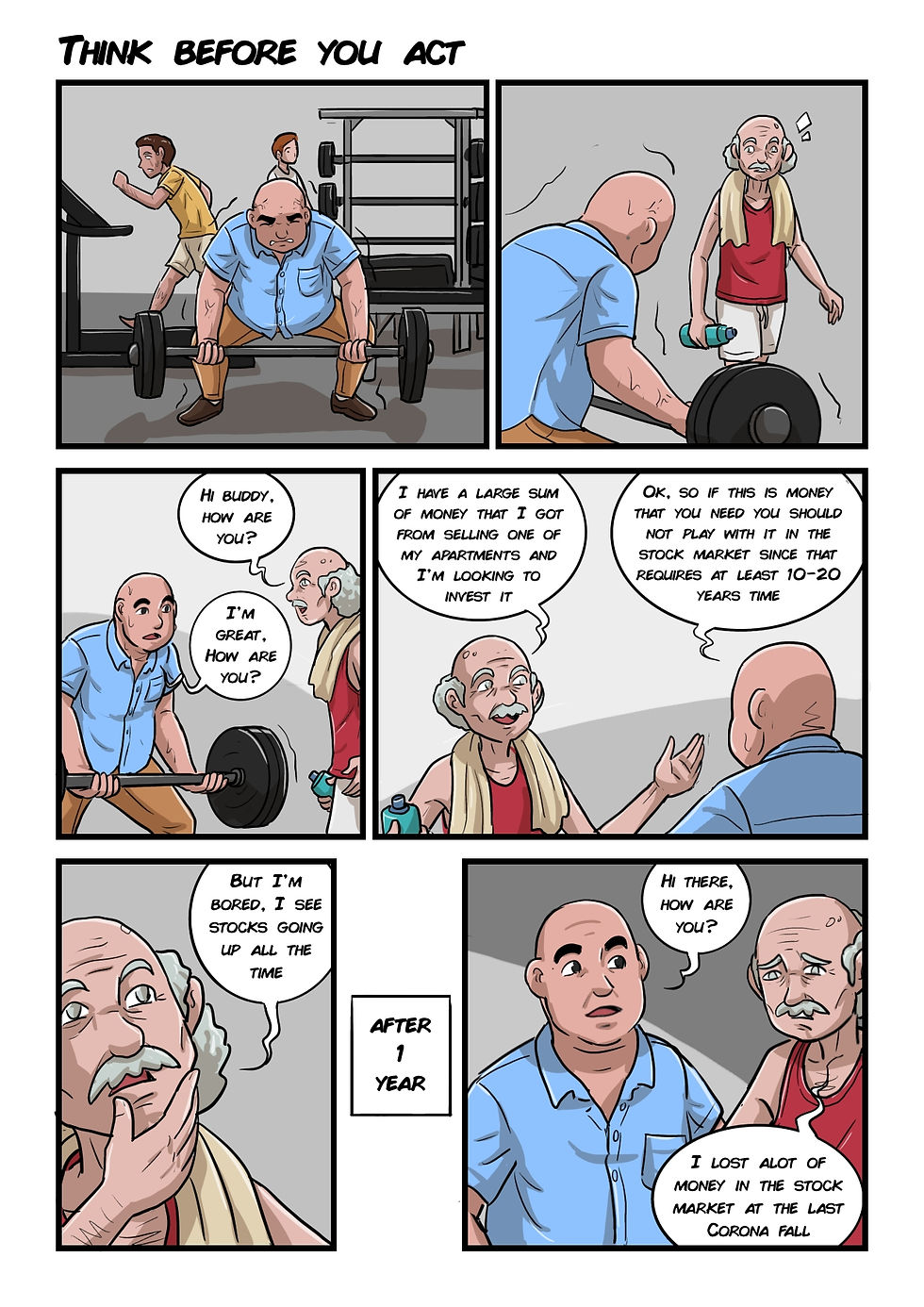

I've often come across people who hurriedly rush to invest in the capital market or real estate market, taking loans and leveraging assets because they want' to hurry and not miss the increases. There have been many cases where people made excellent profits on paper (and off paper), but nearly equally as many cases of people who lost a lot of money, and sometimes even their pension, to my dismay.

People always ask on various forums if they should take a loan and invest it in the capital market, or where they can get a bigger loan for the purpose of investment. However, with every chance for profit, there is also a chance for loss – that is one of the fundamentals of investments, and one of the first things taught in financing and investment courses.

Some studies claim that from a psychological standpoint, the intensity of a loss is double than the intensify of a profit. The first to propose the concept of Loss Aversion were Israeli psychologists Daniel Kahneman and Amos Tversky. Loss aversion leads to risk aversion when people assess possible profits, because people prefer to prevent loss rather than make profit.

In my experience, this is what leads people to pull their long-term investment, and creates immediate, painful loss.

Unfortunately, during the initial stages of Covid I've seen it happen quite often…

Here are some clever sayings that helped me:

'We don't have to be smarter than the rest. We have to be more disciplined than the rest'/ Warren Buffet

'For most of us, beating the stock market isn't a particularly difficult task; the more amazing task is overcoming ourselves. In this sense, overcoming ourselves means controlling our emotions and trying to think independently, as well as avoiding the influence from those around us' / Martin Ferring

What I can say is that professionals exist for a reason. Can you imagine a situation where a pipe bursts in your home, and instead of listening to the advice of a plumber, you act on the contrary?

Investment advisors, insurance agents and financial planners are professionals who went through training and tests to ensure that their clients can benefit from their advice. These are people who live the investment markets and can provide the proper, good advice in the field. Listen to them.

Don't invest in what you don't understand, and if you don't understand – try improving your understanding via books, courses and conversations with people in the field. Take yourself through a process and assess your level of comfort with the nature of the investment. Don't invest in something that doesn't suit your character and the level of risk you're willing to take. If you'll want to change course and drop the investment in the middle, you'll probably suffer some losses.

I'm not trying to discourage you from investing – just asking you to invest a bit more thought into the options, and remember that one of the options is loss.

Have a great weekend!

*The above statement or any of its parts should not be considered investment or pension advice or recommendations. The above does not constitute advice in the fields of investments, pension or taxation, or substitute data-based, personalized advice. | E&OE

Comments